August Market Commentary: Will a Month of Fresh Data Change the Fed’s Aggressive Stance?

Will a Month of Fresh Data Change the Fed’s Aggressive Stance?

July marked the best month for the markets since November 2020. What happened, after the rout of the first half? We have some ideas.

Inflation has really peaked or is near a peak, and the Fed is newly dovish after September, with lower rate increases in November and December and a decrease (!) mid-2023. It’s also a bear market sparked by better-than-expected earnings. The fly in the ointment? That pesky second quarter GDP contraction that could be interpreted as a sign that we are in or near a recession. But there is other, more positive data too. Let’s get into the data:

- GDP decreased at an annual rate of 0.9 percent in the second quarter of 2022 according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. The decreases were business-investment driven – consumers are still spending

- The personal consumption expenditures price index (PCE) rose 6.8% in June, the biggest 12-month move since the 6.9% increase in January 1982. This is the Fed’s preferred measure of inflation data

- The employment cost index rose 1.3% in the second quarter, and 5.1% on a 12-month basis, the highest increase since 2002. This measure is also closely followed by the Fed

- University of Michigan Consumer Sentiment Index rose to 51.5 in July. This is an improvement over the historical June low of 50

What Does All of That Data Add Up To?

Determining whether we are in a recession is the province of the National Bureau of Economic Research (NBER). They don’t just look at GDP, and they are very measured in calling a recession. Given a broader range of data, including increasing GDI (gross domestic income), strong labor markets, and continued (if slower) wage growth, it’s possible we may not be in a recession. This is the view of Fed Chairman Powell, from his remarks after the 75 basis point increase at the FOMC at mid-month. Even if we are in a recession, or if one is likely in the upcoming months, it may be mild

and short. Chairman Powell telegraphed a likely 75 basis point increase in September but opened the “data dependent” door to potentially lower rate increases for the rest of the year.

The Fed is aware of the pain that fighting inflation is causing, but once it has achieved some “slack” in the economy – interpreted as lower employment – it may be willing to reassess future rate increases.

Remember, the Fed only has demand tools in its arsenal. It raises rates to lower investment, which puts downward pressure on growth, which impacts both jobs and wages, and eventually lowers inflation. Inflation isn’t just demand-based. There is a big supply component, and that is still hostage to the invasion of Ukraine and ongoing supply chain disruptions.

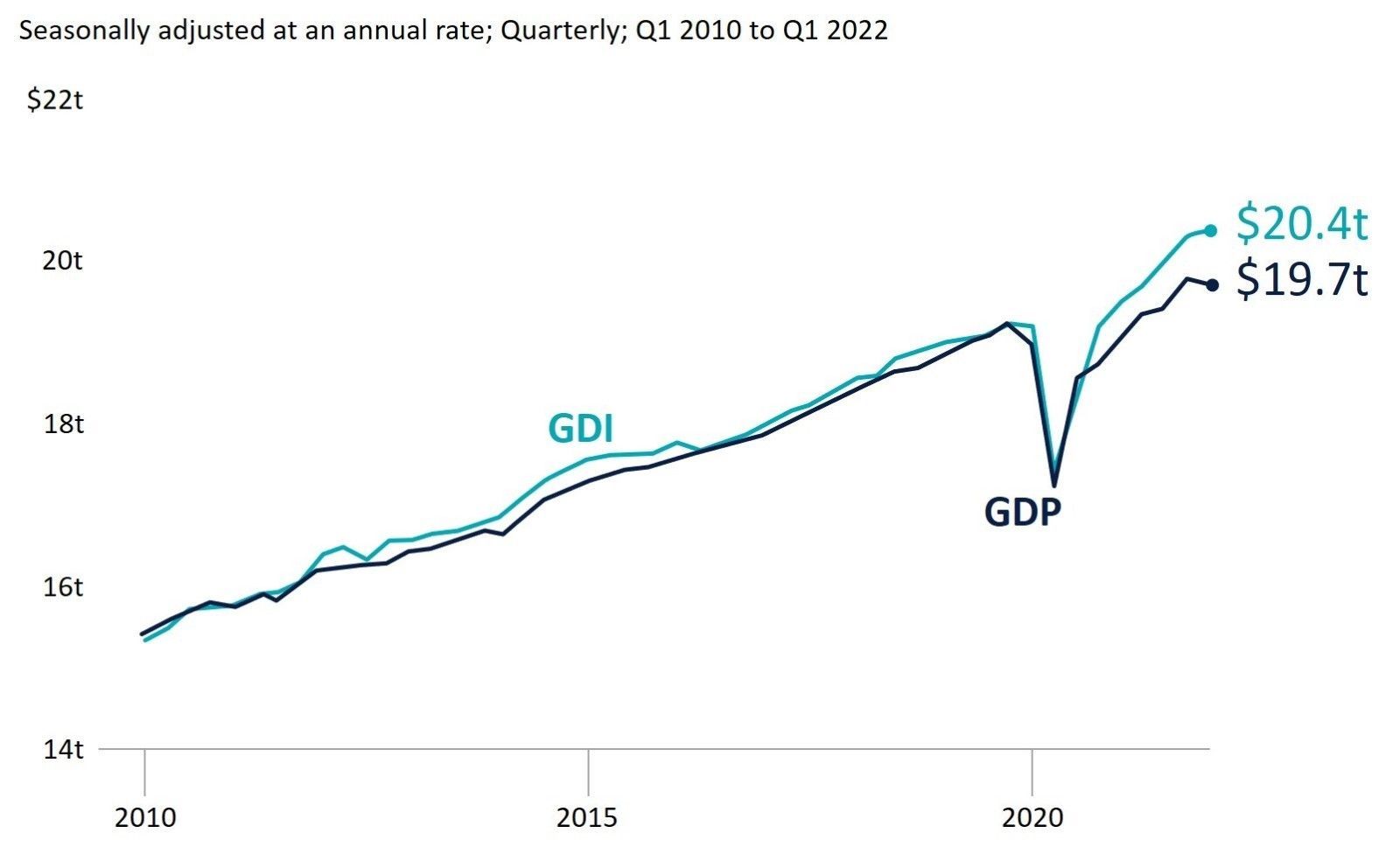

GDP vs GDI: The Trajectories are Diverging

Gross domestic income (GDI) paints an expansion picture, and GDP signals a contraction. Economists look at an average of the two. They are both subject to revision, which usually puts them back on a parallel path. Research from the Fed has found that since the 1990s, initial GDI growth estimates tend to predict eventual revisions to GDP.

Equity Markets in July

- The S&P 500 was up 9.11%, bringing its year-to-date return to -13.34%

- The Dow Jones Industrial Average gained 6.73%, for a year-to-date return of -9.61%

- The Nasdaq Composite was up 12.4%, but remains in bear territory YTD at -20.80

Source: All performance as of July 29, 2022

Image Source: Commerce Department; Chart Axios Visuals

Earnings results and guidance were a big part of the rally. As of month end, 278 issues have

Reported, with 209 beating estimates (75.2%) and 67.9% beating estimates on sales. Overall Q2 earnings are expected to post a 7.3% increase over Q1 2022.

Bond Markets

The 10-year U.S. Treasury ended the month at 2.66%, down from 2.98% in June. At year-end 2021, this rate was at 1.51%. The 30-year U.S. Treasury ended July at 3.02%, down from 3.19%. The Bloomberg U.S. Aggregate Bond Index ended July with a return of 2.44% but is still down year-to-date with a return of -8.16%. The Bloomberg U.S. High Yield Index returned 5.90%.

The Smart Investor

The Fed uses the phrase “data dependent” to indicate that it will be revising its position on interest rate increases as the economy responds to the increases it has already enacted.

Fed Chairman Powell stated that the 25-basis point increase in March, a 50 basis point increase in May, and 75 basis point increases in June and July that have raised the Fed funds rate to 2.25%-2.50% may have created more economic slowing than is reflected in the current economic data. He termed it “in the pipeline.”

For the Fed, this means it may decrease rate increases if inflation declines and the job markets shows more signs of loosening.

But what does that mean for you?

- Even if the Fed slows the pace of rate increases – rates are still going up

- Investors are seeing a bounce in asset values, but the overall amount of volatility has increased, and that makes planning more challenging

- And as consumers, goods still cost more, and any type of loan or debt is still more expensive

How should you prepare yourself for this to continue, at least to the end of the year?

Think about three dimensions of wealth planning:

- Budgets and cash flow planning. Keep expenses on track or lower them, and tie income closely to short- and long-term goals. If you don’t have a cash flow plan, now is the time to get one in place

- Taxes. You want to keep as much income as possible. Tax-loss harvesting, charitable giving, and Roth conversions are all measures to consider

- Potentially avoid making big swings in your allocation – but look at incremental changes to rebalance risk or take advantage of opportunities

And finally, one big thing about mental and emotional health. Keep in mind that bear markets are generally short, and recessions end. Once you’ve done the necessary advance planning, don’t let the market volatility interrupt your life.

Disclaimer:

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.